Impact Project: Tax differentiation for climate-adaptive buildings: tax or reward rainwater

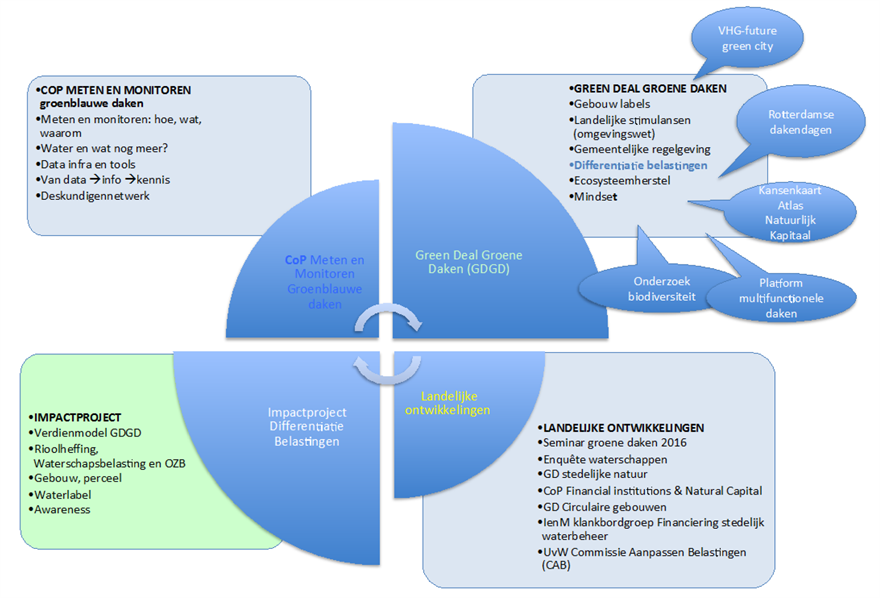

The report written within the framework of the “Tax Differentiation for climate-adaptive buildings” impact project focuses on these questions. The idea for this project came about within the Green Roofs Green Deal. The simple concept was that if a green roof ensures that less rainwater runs into the sewer and the water purification process, then the owner of that roof should have to pay less tax. Or vice versa: the person that does nothing in this respect should bear the increasing costs of draining away rainwater via higher taxes. This project reviews the legal, regulatory, financial and practical technical aspects of the tax differentiation.

The project ran parallel to a national exploration of the desirability of tax differentiation, which comprised the Commission for Tax Reform (Commissie Aanpassing Belastingen - CAB) set up by the Dutch Water Authorities. To keep the project from breaking free of current developments, a team of experts was formed who have worked out what is possible and what is not possible in collaboration with the Municipality of Enschede, the District Water Boards Aa and Maas, Dommel and Vechtstromen, as well as other participants from the Green Deal working group on Tax Differentiation.

Differentiation via property taxes (OZB) seems to encounter legal and practical objections the most. Because property tax constitutes only a (small) percentage of the real estate appraisal value (WOZ), it seems to be more interesting to make tax differentiation possible via other pathways. Because the real estate appraisal value works the same for every owner of property, a change in the law would promote legal equality and legal certainty, and prevent unequal treatment.

The pathways studied have more snags than was previously thought. What the financial consequences of changes in the law are for citizens, the property owner, the treasury and local taxes cannot be determined beforehand. Further study will need to be conducted. The scope of the tax benefit can also be determined, aligned with the desired effect on the national environmental objectives. What is certain is that the differentiation of taxes will raise awareness with respect to the greater use of rainwater in a building and on the property.

Results

It quickly became clear that the differentiation of the sewerage levy, aimed at reducing the amount of rainwater drained away, seems to be feasible and that the current legislation leaves room for this. It requires the current sewerage levy to be adapted and it will lead to a shift in the tax burden. It will require administrative courage to take the next step towards this from the conviction that it will contribute to making the city more sustainable.

Within the district water board taxes, the water system levy and the water purification levy have been studied. The study makes it clear that differentiation in these taxes cannot be simply introduced and that it will require an amendment to legislation. One of the conclusions drawn is that an additional discount scheme could be set up when the legal framework is revised to make differentiation possible.

Photo: Life on roofs.

Contact person

Carleen Mesters

Stroom en Onderstroom

+31 (0)6 21 50 89 14

vraag@carleenmesters.nl

Anne-Marie Bor

NextGreen

06 12 63 40 71

info@nextgreen.nl